Loya Insurance Company – Non-Owner Coverage

Best Rates from Us & Our Partners!*

Call us 855-620-9443

Best Rates from Us & Our Partners!*

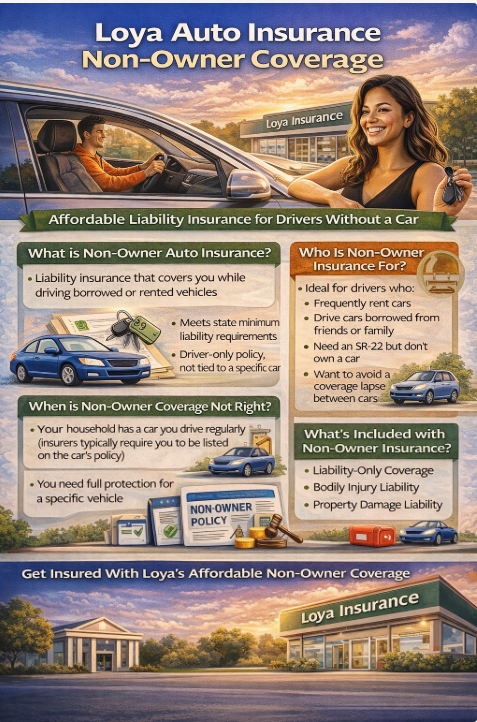

Loya Insurance Company provides low-cost non-owner insurance coverage for many situations. The reality is, not everyone who needs car insurance owns a vehicle. Many drivers borrow cars, rent vehicles, or are required to carry insurance for legal reasons, even though they don’t have a car registered in their name. In these situations, non-owner auto insurance can be a practical and affordable solution. Loya Auto Insurance non-owner coverage is often considered by drivers who need proof of insurance without the cost of insuring a specific vehicle.

Understanding how non-owner coverage works, who it’s for, and when it makes sense can help you decide whether this option fits your situation.

Non-owner auto insurance is a liability-only policy designed for drivers who do not own a car but still drive occasionally. Instead of covering a specific vehicle, the policy follows the driver. It provides liability protection if you cause an accident while driving a car you do not own.

This type of policy typically covers bodily injury and property damage you may cause to others. It does not cover damage to the vehicle you are driving, and it does not include comprehensive or collision coverage.

Non-owner coverage is often used to meet state insurance requirements, maintain continuous coverage, or satisfy SR-22 filing obligations.

Loya Auto Insurance offers non-owner coverage as part of its focus on non-standard and high-risk drivers. The policy is structured to meet state minimum liability requirements without tying coverage to a specific car.

When you drive a borrowed or rented vehicle, the vehicle owner’s insurance is usually primary. Loya’s non-owner policy typically acts as secondary liability coverage, stepping in if the owner’s coverage is insufficient or if you are required to carry insurance independently.

Because no vehicle is insured, premiums are often significantly lower than standard auto insurance policies.

Non-owner auto insurance is not a one-size-fits-all product, but it can be ideal for certain drivers.

It often makes sense for people who:

For drivers in these situations, non-owner coverage can be the cheapest way to stay insured and legally compliant.

Non-owner insurance is not suitable for everyone. If you have regular access to a vehicle owned by someone in your household, most insurers—including Loya—will not allow non-owner coverage. In those cases, you are typically expected to be listed on the household vehicle’s policy.

Non-owner coverage also does not work if you want protection for the car itself. Damage to the vehicle you are driving is not covered, and you would be responsible for repairs unless the owner’s policy applies.

Loya non-owner policies are usually limited to liability coverage. This includes:

Coverage limits must meet your state’s minimum requirements, though higher limits may be available depending on location and underwriting guidelines.

Optional coverages such as comprehensive, collision, towing, or rental reimbursement are generally not included because no specific vehicle is insured.

One of the most common reasons drivers seek non-owner insurance is to satisfy an SR-22 requirement. If your license was suspended and reinstatement requires proof of insurance, a non-owner policy can often fulfill this obligation if you do not own a car.

Loya Auto Insurance is frequently used for SR-22 filings because it works with high-risk drivers and offers policies that can be filed with the state. Non-owner SR-22 policies are often much cheaper than standard owner policies, making them an attractive option for drivers focused on affordability.

The key requirement is maintaining continuous coverage for the full SR-22 period. Any lapse can result in additional penalties or extended filing requirements.

Non-owner auto insurance is typically one of the least expensive ways to stay insured. Since no vehicle is being insured and risk exposure is lower, premiums are generally lower than standard auto policies.

Costs vary based on driving history, state requirements, and whether an SR-22 is required, but many drivers find non-owner coverage to be a budget-friendly option when ownership isn’t necessary.

Loya’s flexible payment options can also help drivers manage costs, especially those who need insurance for legal compliance rather than daily driving.

Maintaining continuous insurance coverage is important even if you don’t own a car. Gaps in coverage can increase future insurance rates, especially for drivers with violations or prior lapses.

Non-owner coverage allows drivers to stay insured while transitioning between vehicles or rebuilding their driving record. Over time, consistent coverage can help reduce premiums when switching back to a standard auto policy.

To qualify for non-owner coverage, you generally must:

Providing accurate information during the quote process is critical. Misrepresenting vehicle access can result in denied claims or policy cancellation.

Standard auto insurance is designed for vehicle owners and includes coverage for a specific car. Non-owner insurance removes vehicle-related costs but limits protection strictly to liability.

For drivers who rarely drive or are temporarily without a car, non-owner coverage is often the smarter and cheaper choice. For drivers who regularly use a vehicle, standard coverage is usually required.

Once you purchase or regularly use a vehicle, non-owner coverage is no longer appropriate. At that point, you should transition to a standard auto insurance policy to ensure the vehicle itself is covered.

Failing to switch policies after acquiring a car can leave you uninsured for vehicle damage and may violate policy terms.

Loya Auto Insurance’s non-owner coverage is a practical solution for drivers who need liability insurance without owning a vehicle. It offers an affordable way to stay insured, maintain continuous coverage, and meet legal or SR-22 requirements.

For drivers who borrow or rent vehicles, are between cars, or need insurance strictly for compliance purposes, non-owner coverage can provide peace of mind without unnecessary expense. As with any insurance decision, choosing the right policy depends on an honest assessment of your driving habits and needs. Compare the best and cheapest non-owner car insurance plans where you live in minutes. Save hundreds with direct rate pricing.