Loya Non-Owner Insurance

Best Rates from Us & Our Partners!*

Call us 855-620-9443

Best Rates from Us & Our Partners!*

There’s a common misconception that car insurance is only for people who own cars. In reality, many Americans regularly drive vehicles they don’t own—rental cars, borrowed cars, and company vehicles (and sometimes a friend’s car in a pinch). For these drivers, a traditional policy that insures a specific vehicle may not make sense, but they may still want liability protection. That’s where non-owner insurance comes in: a policy designed to cover you as a driver, not a specific car.

Important: Coverage rules, eligibility requirements, and what’s “allowed” can vary by state, insurer, and policy language. If you’re unsure whether you qualify (especially with SR-22 requirements, household vehicles, or regular access to a car), confirm details with a licensed insurance representative before purchasing.

Quick Summary

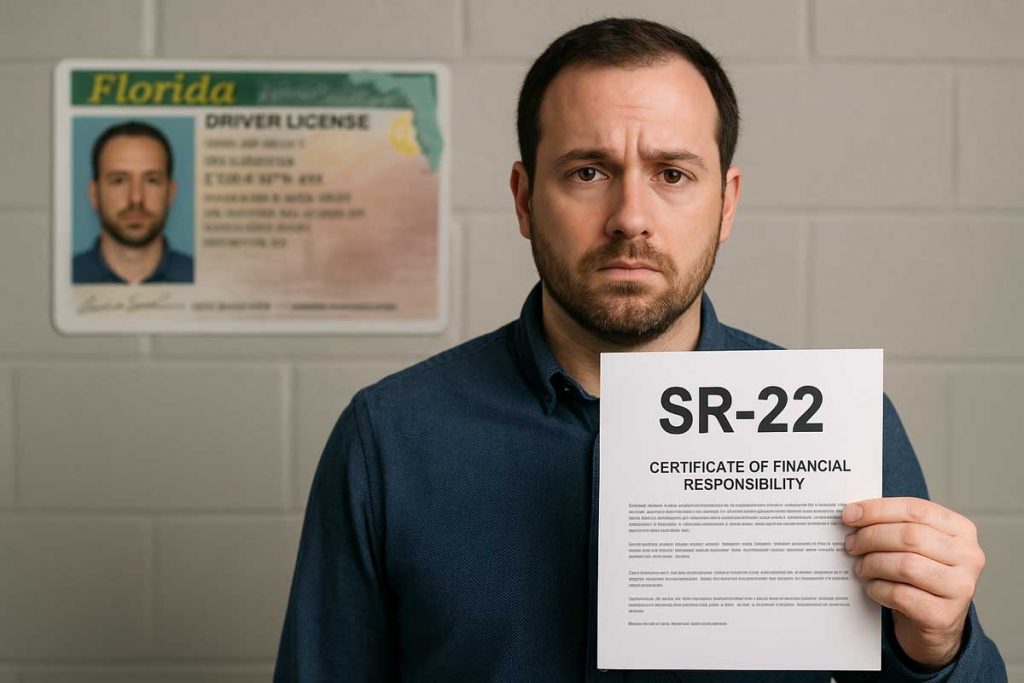

If you’re looking specifically for non-owner coverage, start here: Loya non-owner insurance. This type of coverage can be especially helpful for high-risk drivers who need an SR-22 filing even if they don’t currently own a car. It may help you stay compliant with state requirements, maintain continuous insurance history, and avoid added complications that can come with lapses in coverage.

This guide explains what non-owner insurance is, who it’s designed for, what it typically covers (and typically doesn’t), how it can work with an SR-22, what affects pricing, and when it makes sense to switch to a full auto policy.

A non-owner policy is different from what most people think of as “auto insurance.” Instead of insuring a specific vehicle (with a VIN, mileage assumptions, and physical damage options), the policy is primarily built around covering you as a driver when you occasionally operate vehicles you do not own.

The main focus is usually liability. In most cases, non-owner policies are liability-focused, which means they can help pay other people if you cause an accident—covering their injuries, property damage, and related expenses—up to the limits you choose. Depending on your state and insurer, some non-owner policies may also offer add-ons like uninsured/underinsured motorist coverage or medical payments coverage. Availability varies.

The easiest way to think about non-owner insurance is as a “driver’s liability policy” rather than a “car policy.” It generally follows you, not a particular vehicle.

Not everyone needs a non-owner policy, and some drivers buy the wrong type of insurance because they don’t realize how eligibility works. Non-owner insurance is usually designed for people who fit one or more of these situations:

If you borrow a friend’s car on weekends, occasionally drive your parents’ vehicle, or only drive from time to time, a non-owner policy can provide liability protection when you’re behind the wheel. The car’s owner still needs their own insurance, and your coverage may apply after the owner’s policy depending on the situation, state rules, and policy language.

Rental companies often offer daily coverage options at checkout. A non-owner policy can sometimes satisfy the rental company’s liability requirement and may reduce what you need to buy at the counter.

Rental warning: A non-owner policy typically covers liability, not damage to the rental car. If you want protection for the rental vehicle itself, you’ll usually need the rental company’s collision damage waiver (CDW) or another form of physical damage protection (if available and applicable).

This is one of the most common reasons people look for non-owner policies.

If the state requires you to file an SR-22 but you don’t own a car, you may still need to comply to keep (or reinstate) your license. A non-owner SR-22 policy is often one of the most cost-effective ways to stay compliant when you don’t have a vehicle to insure. If you’re comparing SR-22 options, see: Loya SR-22 insurance.

Many insurers consider coverage gaps when pricing a new policy. Even if you didn’t own a car, a long lapse can sometimes lead to higher premiums later. Maintaining continuous coverage with a low-cost non-owner policy may help you avoid the “gap” problem when you later transition into a standard policy.

If you sometimes drive an employer’s vehicle, ask your employer what the company policy covers (and whether personal use is covered). In some cases, a non-owner policy can help provide additional liability protection, but this is very situation-specific—confirm how coverage applies before relying on it.

In short, non-owner insurance is usually best for drivers who operate vehicles but don’t own vehicles and only drive occasionally—not for people who regularly use the same car day-to-day.

Because the policy is built around the driver rather than a specific vehicle, the process is often simpler than a traditional auto policy. Here’s what commonly happens:

After that, you maintain the policy and use it for occasional driving situations that fit the policy terms. It is often cheaper than insuring a vehicle with collision/comprehensive, but pricing and eligibility still depend on your personal risk factors.

Most non-owner policies center on liability coverage at the limits you choose. Liability is the part of auto insurance that helps protect you if you cause injuries or property damage to others. If you want a deeper breakdown of liability and why limits matter, see: benefits of liability coverage in auto insurance.

If you cause a crash and injure someone, bodily injury liability can help pay (up to your policy limits and subject to state law) for things like:

If you damage another vehicle or property—such as a fence, building, gate, or parked car—property damage liability can help pay for repairs or replacement up to your chosen limits.

Some states and insurers allow uninsured/underinsured motorist (UM/UIM) coverage on non-owner policies. This can help protect you if someone hits you and doesn’t have enough insurance to cover your injuries. Availability, rules, and limits vary widely.

In some states, you may be able to add Medical Payments (MedPay) or Personal Injury Protection (PIP) to help pay for injuries regardless of fault. These coverages are state-specific, so review your options with a licensed representative.

Non-owner insurance is intentionally limited and typically does not include physical damage coverage for the vehicle you’re driving. In most cases, it won’t cover:

About “who pays first”: In many situations, the vehicle owner’s insurance may be primary, and a non-owner policy may apply depending on how the claim is handled, the coverages involved, state rules, and policy language. Because priority of coverage can be complicated, confirm how your non-owner policy works in your state—especially if you expect to borrow a car frequently.

Many insurers restrict non-owner policies to “occasional driver” situations. You may not be able to purchase (or keep) a non-owner policy if:

The practical rule is:

Non-owner policies are usually meant for occasional drivers, not primary drivers.

If an insurer determines you regularly drive a specific vehicle while insured on a non-owner policy, the policy could be canceled or a claim could be impacted based on the facts and policy terms. If your driving situation changes, update your policy promptly.

Non-owner insurance is often less expensive than a standard policy because it usually does not include collision/comprehensive coverage for a vehicle, and it’s priced for occasional driving. That said, your cost can still vary significantly based on personal risk factors.

What typically affects price the most:

| Factor | Why it matters |

|---|---|

| SR-22 requirement | Often increases cost because the driver is considered higher-risk and the filing must be maintained continuously. |

| Driving record | Recent tickets, accidents, DUI/reckless driving, and suspensions can raise rates. |

| Liability limits | Higher limits usually cost more, but can provide better protection in a serious claim. |

| Insurance history | Long gaps in coverage can sometimes increase the premium when starting a new policy. |

| State rules | Minimum requirements and allowable coverages vary by state, impacting pricing and options. |

If you want to compare what coverages exist in general (and how liability fits into a larger policy), review: Loya auto insurance coverages. It helps you understand what you’re getting with non-owner insurance versus a full owner policy.

If you’ve been ordered to carry an SR-22 but you don’t currently own a car, a non-owner SR-22 policy can be one of the most affordable ways to stay compliant.

Here’s how it commonly works:

SR-22 tip: If you miss payments or let the policy lapse, insurers may be required to notify the state that your SR-22 is no longer active. That can lead to reinstated penalties or a new suspension in many states, so keeping coverage continuous is critical.

If you later buy a car, you can often switch to a standard auto policy without interrupting your SR-22 requirement as long as you change the policy promptly and keep coverage active.

For the right driver profile, non-owner insurance can offer real advantages:

Because the policy typically focuses on liability and doesn’t insure a specific vehicle for physical damage, it’s often cheaper than a full-coverage owner policy.

Keeping continuous coverage can help avoid pricing penalties associated with coverage gaps when you later transition into a standard policy.

If you must file an SR-22 but don’t own a car, non-owner coverage can help you meet the requirement without insuring a vehicle you don’t have.

If you cause a crash while driving a borrowed vehicle, a non-owner policy can help protect you financially from injuries or property damage you cause to others, up to your policy limits.

Non-owner insurance is often a temporary solution. Consider switching to a standard auto policy if:

Waiting too long to upgrade can create serious coverage problems if an accident happens and your policy terms don’t match your real driving situation.

Availability depends on the state you live in and what insurers offer there. Even within the same brand, products can vary by state. A licensed representative can confirm whether non-owner coverage and SR-22 filings are available where you live.

In most cases, no. Non-owner policies are typically designed around liability and do not insure a specific vehicle for physical damage. If you need to protect a financed or owned vehicle, you’ll usually need a standard policy that insures that specific car.

It can. Many insurers consider continuous coverage when pricing new policies. Maintaining coverage on a non-owner policy may help you avoid the pricing impact of a major lapse when you later transition to a standard policy.

If you live with someone whose car you drive regularly, a non-owner policy may not be appropriate. Many insurers expect regular household drivers to be listed on the household vehicle’s policy. Because this is a common “denial risk” situation, confirm eligibility before purchasing.

Missing payments can lead to a lapse or cancellation. In many states, if your SR-22 policy cancels, the insurer may notify the state, which can trigger reinstated penalties or a new suspension. If you’re required to file SR-22, keeping coverage continuous is one of the most important parts of staying compliant.

Non-owner insurance is one of the most useful—and most misunderstood—insurance products. It can provide liability-focused protection for people who don’t own a car but still drive occasionally, and it can be a practical option for drivers who need to maintain an SR-22 without paying for a full owner policy.

If you’re trying to stay compliant, avoid coverage gaps, or protect yourself when borrowing cars, the key is to use non-owner coverage correctly, understand its limitations, and upgrade when your driving situation changes. If you’re ready to compare options, use this guide to start: how to get a Loya car insurance quote.