Cheap Car Insurance From Loya

Best Rates from Us & Our Partners!*

Call us 855-620-9443

Best Rates from Us & Our Partners!*

If you live in the Southwest (or a handful of other U.S. states), you’ve probably seen Loya Insurance marketed as a fast way to get “cheap” car insurance with a low upfront payment and flexible billing. For drivers who’ve been canceled, quoted high rates, or need coverage quickly, that message can feel like a lifeline.

But a low monthly payment is only a win if the policy actually protects you when something goes wrong. The smart approach is to understand (1) what Loya typically offers, (2) where “cheap” policies can leave gaps, and (3) how to compare quotes using the same limits and deductibles so you’re not fooled by a low “first payment.”

This guide walks you through Loya’s common coverage options, the tradeoffs that can come with low-premium policies, and a practical checklist to help you keep costs down without underinsuring yourself.

Quick note: Auto insurance rules (minimum limits, PIP/MedPay availability, uninsured motorist rules, and fees) vary by state and sometimes by carrier. Use this article as general education, then confirm details on your quote and declarations page before you bind a policy.

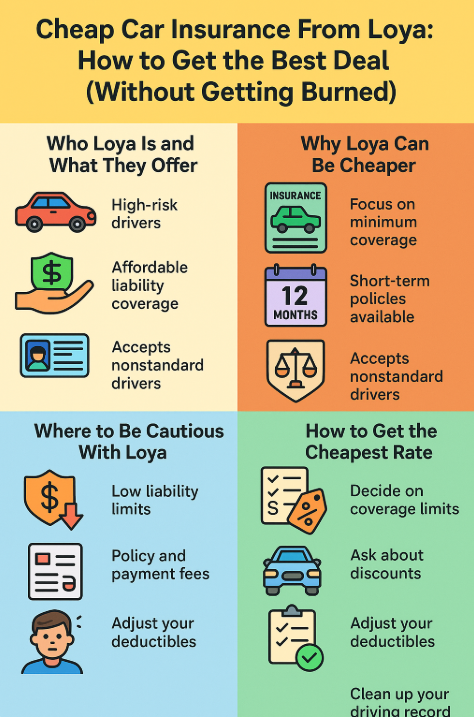

Loya Insurance is often described as a regional auto insurer that serves many budget-conscious and “nonstandard” drivers (for example: drivers with tickets, a lapse in coverage, or limited insurance history). Instead of relying only on apps and national advertising, Loya is known for local offices and phone/in-person support in many areas.

Coverage options generally look similar to what you’d expect from many carriers: liability (bodily injury and property damage), optional comprehensive and collision for damage to your own vehicle, and add-ons like uninsured/underinsured motorist coverage where available. If you want a plain-language overview of common policy parts before you shop, start here: Loya auto insurance coverages explained.

Before you focus on price, decide what you actually need: state-required minimums may keep you legal, but they can be very low relative to real-world medical bills and vehicle repair costs.

When someone says “Loya is cheaper,” they’re often describing one of these scenarios:

To keep the comparison fair, always ask for the total term cost (including any fees) and confirm that each quote uses the same limits and deductibles. If you want a clean process for quoting, this guide can help: how to get a Loya car insurance quote.

The main risk isn’t “Loya” specifically—it’s buying a policy based on the smallest monthly payment without checking what you’re actually covered for.

1) Liability limits that are too low. Many states allow low minimum limits. As a simple example (not a universal standard), a policy might show limits like 25/50/25. If you cause a crash with multiple injuries or significant property damage, costs can exceed those limits quickly—leaving you responsible for the remainder.

2) Coverage gaps that surprise drivers. Some “cheap” quotes exclude uninsured/underinsured motorist coverage, rental reimbursement, roadside assistance, or comprehensive/collision. If your vehicle is financed, your lender may require physical damage coverage.

3) Fees and billing structure. Many insurers (especially when billed monthly) may include items like policy fees, installment fees, SR-22 filing fees, reinstatement fees, or late fees. These can change the real cost of the policy over the term—even when the monthly premium looks low.

When you get a quote, ask the agent (or confirm in writing) the following items so you can compare accurately:

Also ask for the declarations page or a quote summary that lists limits, deductibles, drivers, vehicles, and coverage effective dates. That’s the fastest way to avoid misunderstandings.

If you decide to quote Loya, go in with a plan. Your goal isn’t “the cheapest thing available”—it’s the cheapest policy that meets your minimum protection standard.

Step 1: Set your protection floor. Think about income, savings, and assets. Many drivers choose limits above the state minimum for a safer buffer (your best fit depends on your situation and state requirements). If uninsured motorist coverage is available where you live, consider it—many drivers carry low limits, and some drive without insurance entirely.

Step 2: Decide on full coverage (or not). If your car is financed or hard to replace, comprehensive and collision may matter. If you do choose full coverage, one common way to reduce premium is adjusting deductibles. Learn the tradeoffs here: Loya insurance deductibles explained.

Step 3: Control the conversation. Use a script like: “I need these limits and these deductibles—please quote the lowest price that meets them, and itemize the down payment and any fees.” This keeps you from drifting into bare-minimum coverage just to shave a few dollars off the first payment.

Discount availability varies by state and carrier, but it’s still worth asking what applies to you today and what could apply later. Common savings categories can include multi-vehicle, prior insurance/continuous coverage, safe driving, paid-in-full options, or billing-related savings (for example, avoiding installment fees by paying in fewer payments).

If you’re shopping because you’ve had violations or a lapse, improving your record and maintaining continuous coverage can be one of the biggest long-term “discounts” there is. (Even if your price doesn’t drop immediately, it often improves as time passes without new incidents.)

A fair comparison looks at more than a monthly number. When you compare Loya to other options, make sure each quote matches:

If you want a broader shopping framework, you can use this as a comparison baseline: compare auto insurance quotes for best rates. Even if you ultimately choose Loya, the exercise helps you confirm the “cheap” policy is truly a good deal for your situation.

Does “low down payment” mean the policy is cheaper overall?

Not always. It usually describes the first amount due. Always ask for the total cost for the full term, including fees.

Can I get full coverage with Loya?

Depending on state and underwriting, many drivers can add comprehensive and collision. Confirm deductibles and whether rental/roadside are included or optional.

Is minimum liability enough?

Minimum limits keep you legal, but they can be low compared to real accident costs. Consider higher limits if you have income, savings, or assets you want to protect.

What’s the best way to avoid surprise costs?

Ask for an itemized quote summary and confirm fees (policy fee, installment fee, SR-22 fee if applicable, and reinstatement/late fees).

Cheap car insurance from Loya can make sense when you need affordable coverage quickly, especially if you’ve been quoted high rates elsewhere or you prefer in-person service. The key is to avoid the two most expensive mistakes: buying limits that don’t protect you and comparing quotes that aren’t truly equivalent.

If you shop with a simple plan—set your coverage floor, request an itemized quote with fees, and compare 3–5 insurers using the same limits and deductibles—you can keep costs low while still protecting your finances. For a deeper overview of how Loya policies are commonly structured, you can continue here: Loya car insurance guide.