Cheap SR-22 Insurance From Loya Insurance Company

Best Rates from Us & Our Partners!*

Call us 855-620-9443

Best Rates from Us & Our Partners!*

You can get cheap SR-22 insurance from Loya Insurance Company and meet the legal requirements, and save more of your hard-earned money. If you’ve been told you need an SR-22, it usually means your driving privileges were suspended or restricted due to a serious violation, such as a DUI or DWI, driving without insurance, too many traffic violations, or a license suspension.

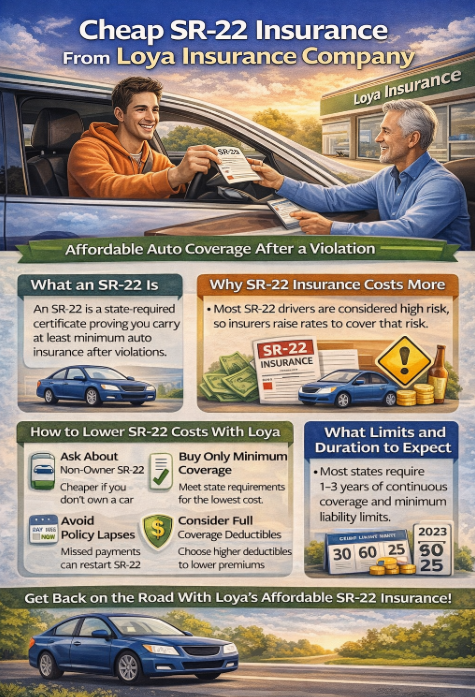

Many drivers mistakenly believe an SR-22 is a special type of insurance, but that’s not the case. An SR-22 is simply a state-required filing that proves you carry at least the minimum liability insurance required by law.

Loya Insurance Company is often considered by drivers looking for cheap SR-22 insurance, especially those who fall into high-risk or non-standard categories. Understanding how SR-22 filings work and how Loya structures coverage can help you meet legal requirements while keeping costs under control.

An SR-22 is not an insurance policy on its own. It is a certificate of financial responsibility filed by your insurance company with the state. The filing confirms that you maintain the required minimum liability coverage and that the insurer will notify the state if your policy cancels, lapses, or expires.

Because of this reporting requirement, SR-22 insurance must remain active continuously. Any lapse in coverage can trigger further penalties, license suspension, and additional fees.

Drivers required to carry an SR-22 are typically classified as high risk. Even though the filing fee itself is relatively small, the underlying insurance premium is often higher due to the violation that caused the SR-22 requirement in the first place.

SR-22 costs usually consist of two parts:

The premium increase is almost always the largest expense, not the SR-22 filing itself.

Loya Insurance Company operates primarily in the non-standard auto insurance market. This means it is accustomed to insuring drivers who may have violations, coverage lapses, bad credit, or license reinstatement requirements.

Because Loya focuses on accessibility rather than preferred-driver pricing, it is often more willing to issue policies that include SR-22 filings. For many drivers who have been turned down elsewhere or quoted extremely high rates, Loya becomes a practical alternative.

The key to finding cheap SR-22 insurance is not just the lowest initial quote, but a policy you can afford to maintain for the entire SR-22 requirement period.

If you do not currently own a vehicle, a non-owner SR-22 policy may be available. Non-owner policies typically cost less than standard auto insurance because they only provide liability coverage when you drive vehicles you do not own.

This option is often overlooked and can be one of the most effective ways to keep SR-22 costs low, especially if you are between vehicles or only drive occasionally.

If your vehicle is older and paid off, you may not need full coverage. Liability-only insurance is usually the cheapest way to satisfy SR-22 requirements.

Drivers with financed or leased vehicles may be required to carry collision and comprehensive coverage. In those cases, cost savings come from deductible choices rather than eliminating coverage.

If full coverage is required, increasing deductibles can significantly lower monthly premiums. This strategy works best if you have enough savings to cover the deductible in the event of a claim.

Maintaining continuous coverage is critical when you have an SR-22. If your policy cancels for nonpayment or lapses for any reason, the state is notified, and penalties can restart.

This can result in:

Choosing a payment schedule you can realistically afford is often more important than choosing the lowest possible premium.

Loya Insurance Company typically offers flexible payment options, which can be helpful for drivers on tight budgets. However, installment plans may include fees that increase the total cost over time.

If possible, paying a higher down payment or reducing the number of installments can lower the overall cost of your SR-22 policy.

SR-22 filings usually certify that you meet your state’s minimum liability insurance limits. These limits vary by state, so it’s important to confirm the exact requirements where you live.

While minimum limits are usually the cheapest option, they also offer the least financial protection. Drivers who can afford slightly higher liability limits may reduce their personal financial risk in the event of a serious accident.

The length of time an SR-22 is required depends on the violation and state law. Common requirement periods range from one to three years, though some violations may require longer durations.

It’s important to verify your exact requirement period and plan your budget accordingly. Ending coverage early or allowing a lapse can extend the requirement and increase total costs.

Many drivers accidentally make SR-22 insurance more expensive than necessary. Common mistakes include:

Avoiding these mistakes can save hundreds or even thousands of dollars over the SR-22 period.

While SR-22 insurance is often seen as a punishment, it can also be an opportunity to rebuild your driving and insurance record. Maintaining continuous coverage, avoiding new violations, and making on-time payments all work in your favor over time.

Many drivers use Loya Insurance Company as a stepping stone while they stabilize their driving record and eventually qualify for lower rates.

Cheap SR-22 insurance is less about finding the lowest quote and more about choosing a policy you can maintain without interruption. Loya Insurance Company offers accessible options for high-risk drivers who need SR-22 filings and flexible payment solutions.

By selecting the right policy type, avoiding lapses, and choosing coverage wisely, drivers can meet SR-22 requirements without unnecessary financial strain. For many, Loya provides a realistic path back to legal driving and insurance compliance.