Deductibles Explained: What They Are and How They Affect Your Insurance

Best Rates from Us & Our Partners!*

Call us 855-620-9443

Best Rates from Us & Our Partners!*

An insurance deductible is one of the most important numbers on your policy, but it’s also one of the easiest to misunderstand. If you pick the wrong deductible, you might end up paying more than you expected after an accident or loss—especially if you file a claim.

This guide explains what deductibles are, how they work for auto and other types of insurance, and how to pick a deductible that fits your budget. You’ll also see real-world examples so you can estimate what you’d actually pay out of pocket.

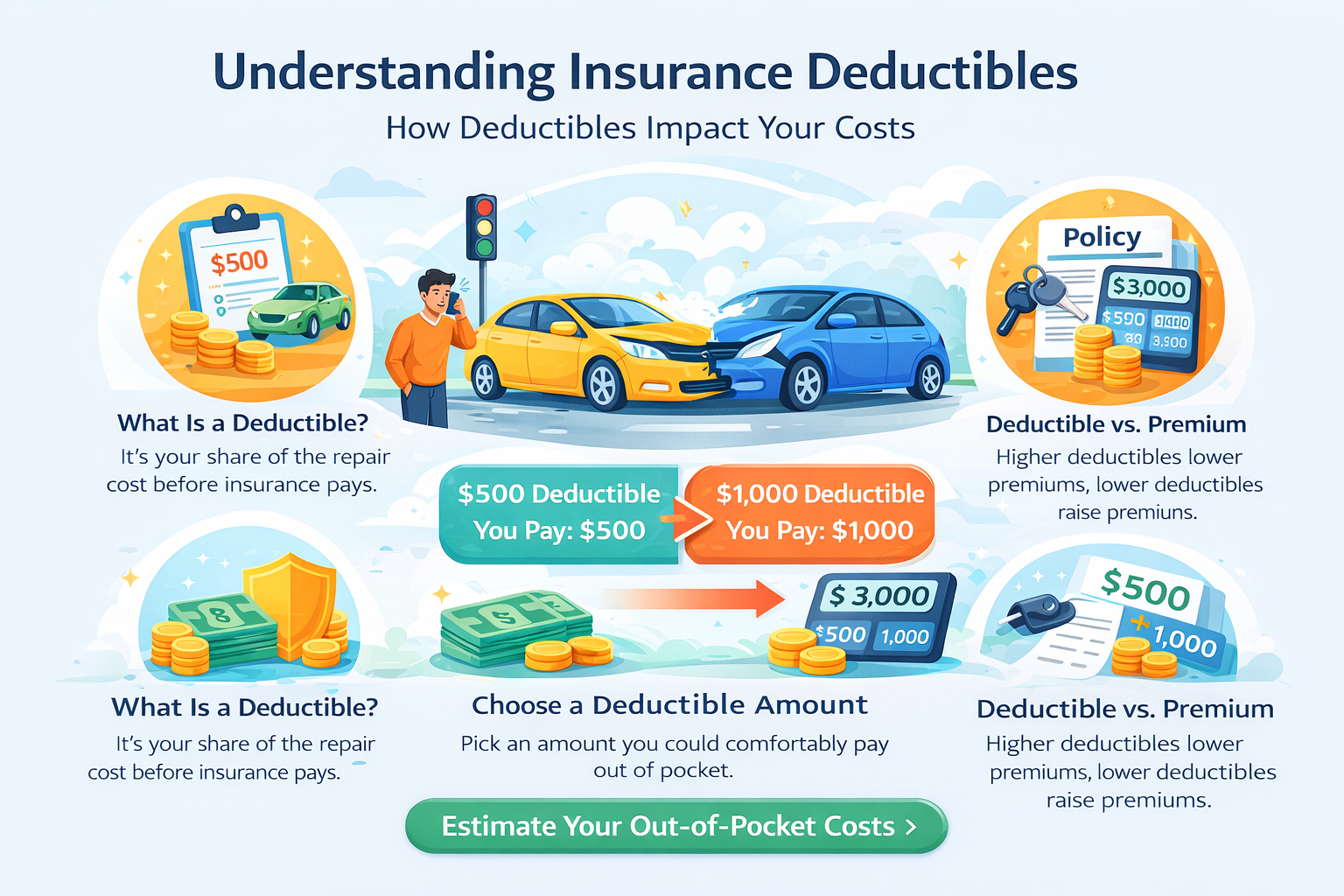

A deductible is the amount you agree to pay out of pocket before your insurance company starts paying on a covered claim. Think of it as your “share” of the loss.

For example, if you have a $1,000 deductible and a covered repair costs $4,000, you would pay $1,000 and the insurer would pay the remaining $3,000 (assuming the claim is covered and within your policy limits).

Deductibles most commonly apply to coverages that protect your property (your car or your home). In auto insurance, deductibles are typically tied to physical damage coverages.

If you want a quick overview of which protections usually include deductibles and which ones don’t, review the major auto insurance coverages so you can match deductible choices to the parts of your policy that matter most.

Many drivers choose different deductibles for collision and comprehensive. Collision claims can be more common (depending on your driving situation), while comprehensive claims can vary based on where you live and how you park your vehicle.

| Coverage Type | What It Covers | When It Applies | Typical Deductible | Why It Matters |

|---|---|---|---|---|

| Collision Coverage | Repairs to your vehicle after a collision, including crashes with other vehicles or single-car accidents (guardrails, poles, rollovers). |

Applies whenever you file a collision claim, regardless of who caused the accident. | Usually required Common options: $500, $1,000, $2,000 |

Higher deductibles lower premiums but increase out-of-pocket costs after an accident. |

| Comprehensive Coverage | Non-collision damage such as theft, vandalism, fire, hail, flooding, falling objects, or animal strikes. |

Applies when damage occurs from events outside your control. | Usually required Often lower than collision deductibles |

Important for vehicles parked outdoors or in high-risk areas. |

| Liability Coverage | Injuries and property damage you cause to other people in an at-fault accident. | Applies when you are legally responsible for damages. | No deductible | Required by law in most states and protects you from major financial loss. |

In general, a higher deductible lowers your premium because you’re taking on more of the risk. A lower deductible raises your premium because the insurer expects to pay more when claims happen.

But the “best” choice depends on your cash flow and your emergency fund. A low premium can look good on paper, but if the deductible is too high for you to comfortably pay, you may hesitate to file a claim or struggle after a loss.

Here are simple examples to make the math clear. These are illustrations, not a quote or promise of coverage.

Notice how a high deductible can make smaller claims less “worth it.” That’s one reason many people choose a lower comprehensive deductible than their collision deductible—especially if they want more predictable out-of-pocket costs.

Use these practical checkpoints to choose a deductible that makes sense for your situation:

If you had an accident this week, could you pay your deductible without missing rent, food, or other essentials? If the answer is no, your deductible may be too high.

Sometimes increasing a deductible saves only a small amount per month. If the savings are minor, keeping a lower deductible can be worth it for peace of mind.

New drivers, busy commuters, and people driving in heavy traffic may prefer a more manageable deductible. If you’re shopping coverage for a new or younger driver, it can help to read auto insurance for young drivers and see which choices tend to reduce financial surprises.

A deductible is only one part of your true cost. Policy add-ons, gaps in coverage, and claim rules can change what you pay after a loss. If you want to spot common cost traps early, use this guide to hidden costs in auto insurance before you finalize your deductible and coverage mix.

No. Your deductible is only paid when you file a covered claim that has a deductible (for example, a collision or comprehensive claim).

It depends on the claim path and your policy. If you file through your own collision coverage, you typically pay your deductible first. If another driver is clearly at fault and their insurer pays, your deductible may not apply the same way.

Not universally. A $500 deductible usually means higher premiums but lower out-of-pocket cost at claim time. A $1,000 deductible usually lowers premiums but increases your immediate cost after a loss. The right choice depends on your budget and risk tolerance.

Often yes—many policies allow changes at renewal or sometimes mid-term. Changing it may change your premium.

A deductible is the amount you pay out of pocket before insurance pays on a covered claim. Choosing the right deductible is a balance: you want premiums that fit your monthly budget, but you also want a deductible you can comfortably afford if something happens.

If you’re unsure, a good rule is to choose the lowest deductible you can realistically fund without stress—then compare how much extra premium you’d pay for that lower deductible and decide if the tradeoff makes sense.

If you want to compare deductible levels side-by-side (and see how each one changes your monthly price), start here: how to get a Loya car insurance quote.